Key Takeaways:

Bitcoin (BTC) movements can be volatile. Follow your trading plan and trade responsibly. Every market movement has opportunities on both sides, whether you have long and/or short positions.

Regulations are often seen in a negative light, however, regulatory frameworks and laws are actually a good sign. Increasing government interest in crypto indicates an interest to introduce these technologies on a wider level to new and existing markets.

Governments are in a position to introduce new stimulus packages to address economic fallout from COVID-19. The increase in cash liquidity could fuel Bitcoin demand.

Growing interest in Bitcoin and alternative cryptocurrencies (or altcoins) continues to drive the crypto market up. For additional opportunities, be sure to check correlations between BTC and altcoins.

It looks like everything is bright again in the crypto world. After trading below $30,000 as of a few days ago, investors wondered about the future of Bitcoin and its viability as a store of value. However, after another great come-back, the world’s most popular cryptocurrency is trading above the 35,000 technical level, testing the 39,500 resistance and pushing the whole crypto market upwards.

With a $715 billion dollar market cap, Bitcoin is recovering most of the losses it suffered last month. Bitcoin is trading around $38,500, posting a remarkable 30 percent recovery from the July 20 lows at $29,583.

On July 26th 2021, BTC/USD opened the week on a solid note, fueled by both fundamental and technical factors.

BTC/USD daily chart provided by Tradingview

BTC/USD is consolidating prices above critical technical levels such as the 28 and 50 day moving averages. The pair is trading at highs since June 17.

This also means that after three sluggish months, Bitcoin is performing positively in July. Though it’s still too soon to say, some speculate that the 29,000-30,000 dollars floor may be respected in the near future.

Market participants are comparing current Bitcoin price movements favorably to ones that occurred in 2018 and 2019, when BTC fell from $20,000 to around $3,500; and the other in August 2020, when BTC rejected the $12,500 area and declined to $9,800.

Bitcoin: The potential for regulation to enable mainstream adoption

Bitcoin is currently navigating two significant forces, the first being regulation, where local governments are setting up regulatory frameworks and laws to guide the crypto industry. The second force is institutional adoption, where major companies are developing cryptocurrency and blockchain products of their own, in an attempt to reach mainstream audiences.

These two forces may seem contradictory, but they are both positive developments for the blockchain and crypto industry.

When it comes to revolutionary technology that is changing industries around the world, all economic, political and social forces will need to play a key role.

In the end, these factors all affect the price of Bitcoin.

Read more: Why is the crypto market down? A primer on market volatility.

Will crypto soon be accepted by the world’s largest online retailer?

On July 23rd, CNBC reported that Amazon was hiring a digital currency and blockchain expert, "signaling a growing interest in cryptocurrency," according to the website.

The news recalled an Amazon's job posting that said: "You will leverage your domain expertise in Blockchain, Distributed Ledger, Central Bank Digital Currencies and Cryptocurrency to develop the case for the capabilities which should be developed, drive overall vision and product strategy, and gain leadership buy-in and investment for new capabilities." Two days later, a UK news outlet speculated that Amazon was ready to accept Bitcoin payments by the end of 2021, reporting "This entire project is pretty much ready to roll."

As you may know, Amazon is a global e-commerce and technology company. The acceptance of Bitcoin as a method of payment would bring the cryptocurrency closer to mass adoption. It’s unclear how exactly Amazon will incorporate Bitcoin and other cryptocurrencies into its retail or cloud computing business and whether Amazon directly owns any cryptocurrencies. But it is not going to start accepting payments within the year as reports from Amazon confirmed. But what we do know is that the speculation caused a +10% rally on July 26th.

Increased regulatory watch on Bitcoin

The recent regulatory actions have created the impression that cryptocurrency adoption has suffered a setback, driving crypto prices downward. However, in many cases, increasing regulatory watch actually signals maturity in markets.

As more institutions announce their own crypto offerings, regulators have moved in to protect end users and set guardrails that can help provide a clearer regulatory environment for growth.

COVID variants and stimulus packages

Another factor affecting the BTC price in 2021 is the COVID-19 pandemic, which accelerated the digital transformation in many countries around the world, while introducing a bevy of economic issues.

To help people overcome financial difficulties, some governments have opted to launch stimulus packages, injecting cash into the economy—some of which were spent on cryptocurrencies and other digital assets.

However, with news that governments were ready to trim stimulus packages, increase interest rates and stop direct payments, it may have contributed to a slowdown in cryptocurrency buying, potentially impacting prices. It may not be a coincidence that the third stimulus check passed in the United States was in March 2021, a few days before Bitcoin's all-time high at $65,087 on April 14th.

Bitcoin's technical analysis

Bitcoin rallied around 10 percent on Monday, July 26th, turning positive for the month. The reason behind the movement was speculation that Amazon was preparing to accept bitcoin as a payment method (a report that has since been debunked).

From a technical point of view, Bitcoin broke above the 50-day moving average at $34,418 on Sunday, July 25th, driving BTC/USD to higher gains.

In addition, the breaking of the $35,000 and $36,600 resistances also fueled the positive sentiment, which drove the pair to record more gains. Meanwhile, MACD is starting to develop a new uptrend, with momentum looking solid.

Resistances are now identified in the $40,000 area, followed by the June 15th highs of $41,385.

On the downside, the $30,000 level looks like a solid support, but the 28-day moving average is just turning upside, which would signal change. Below the 30,000 critical level, there is the 28,600 support, which has repelled BTC/USD since January 2021—marking a possible floor.

Ethereum also breaks above the 50-day MA and trades above $2,300

ETH/USD daily chart provided by Tradingview

Ethereum also reported significant gains at the beginning of the week amidst its correlation with Bitcoin. Rumors about Amazon also mentioned that other popular cryptocurrencies would join Bitcoin as a possible payment method. Some people took that to mean Ethereum.

After bottoming at $1,717 dollars per coin on July 20th, ETH rallied around 35 percent to trade at $2,340 on July 25th.

ETH/USD also consolidated prices above the 50-day MA at $2,158, and it is now testing the $2,400 area, after July 7th highs.

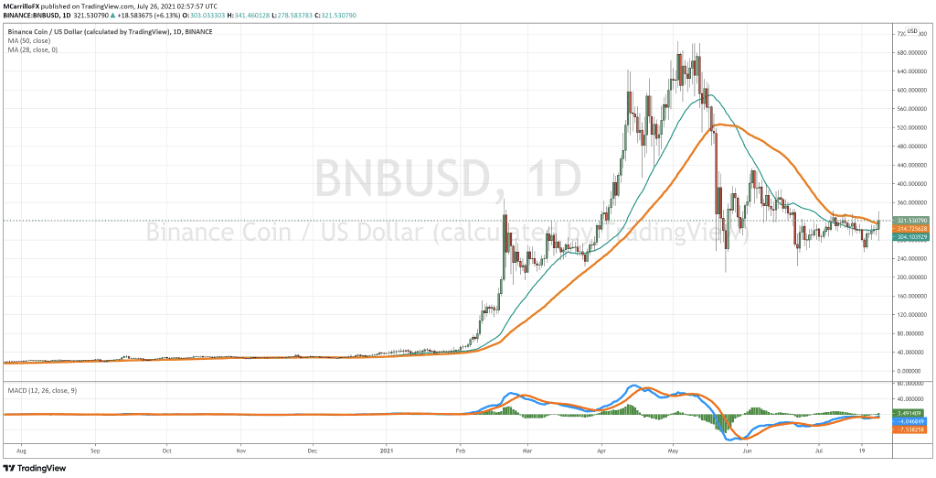

BNB moves higher, but it remains in the range

BNB/USD daily chart provided by Tradingview

BNB rallied 6.5 percent on July 25th. BNB/USD is now trading in the same range it has been trading since June 25th, from 280 to 340.

Cardano ADA rallied 30 percent from July 20th lows

ADA/USD daily chart provided by Tradingview

Cardano rallied at the beginning of the week amid the bullish crypto market. ADA gained 7.7 percent for the day, including a break above the 50-day moving average.

In the middle term, ADA rallied 38 percent from July 20th lows at $1.0070 to July 26th highs at $1.3910. The $1.0000 level has emerged as solid support for the ADA/USD pair in that framework. Again, the key is the 50-day moving average at $1.3557.

Understanding the crypto market

Historically, the crypto market has been a volatile field for investors. Many of them fear volatility, but actually, volatility is good for markets as it represents the exchange of assets and the creation of opportunities.

Cryptocurrencies tend to move faster than many traditional assets. But in the end, it all comes down to how you manage risk and protect your portfolio.

The secret when trading cryptocurrencies is risk management, and the basic rule to become a successful trader is to trade wisely and responsibly. Especially in a market like cryptocurrencies, where movements can be volatile. Keeping a journal and always having a trading plan with entry and exit points and potential profits is essential.

Remember, the market will be there tomorrow. Let's be sure your portfolio will be there too.

Ready to buy cryptocurrencies? Kickstart your cryptocurrency journey with Binance

Get started by signing up for a Binance.com account or download the Binance crypto trading app. Next, verify your account to increase your crypto purchase limit. After you have verified your account, there are two main ways to buy cryptocurrencies on Binance using cash: you can buy crypto with cash from Binance via bank transfer or card channels, or buy crypto with cash from other sellers on Binance P2P.

Linking your debit card, credit card, or bank account (available in many regions) is one of the easiest ways to buy Bitcoin and more than 100+ cryptocurrencies.

Read the following helpful articles for more information:

(Support) How to complete Identity Verification?

(Support) How to Buy Crypto with Debit/Credit Card on the Website and the App

Disclaimer: Cryptocurrency investment is subject to high market risk. Binance is not responsible for any of your trading losses. The opinions and statements made above should not be considered financial advice.