Crypto market in numbers

Negative sentiment prevailed on the market throughout the whole week. The Crypto Fear and Greed Index still has not left the ‘Extreme Fear’ zone and dropped down at 10 points on 21st July. Last time such a low value was recorded a month ago, on 22nd June.

The indicator reflects the market reaction to the fall of bitcoin below $30,000. On 20th July, BTC/USDT pair briefly dropped to $29,230 on the EXMO exchange. Worth noting that the world’s first cryptocurrency managed to hold above the mentioned price for almost a month.

Bitcoin’s 30-day volatility index has dropped from 4.09% to 3.31% etween 15th-21st July.

According to Glassnode, currently $5.3 billion in daily transactions are processed through the BTC network compared to $15.5 billion at the peak of 2021. Arcane Research has noted that bitcoin trading volumes dropped to annual lows. Analysts believe that the activity of bitcoin traders will remain low throughout July and August.

According to CoinGecko, the daily trading volumes during the week did not exceed $87 billion. In May, they were many times higher, and until the beginning of July they were above $100 billion.

All Time High

| Coin | Date | ATH on EXMO, $ |

| CRON | 18.07.2021 | 1.96 |

Losers of the week (15th July – 21st July 2021)

| Coin | Opening price 15.07, $ |

Opening price 21.07, $ |

Change |

| HP | 0.001 | 0.0012 | 22.2% |

| EOS | 3 | 3.34 | 11.5% |

| XEM | 0.12 | 0.13 | 10.3% |

| MNC | 0.0019 | 0.0021 | 9.6% |

| DASH | 124.91 | 128.15 | 2.6% |

Gainers of the week (15th – 21st July 2021)

| Coin | Opening price 15.07, $ |

Opening price 21.07, $ |

Change |

| HP | 0.001 | 0.0012 | 22.2% |

| EOS | 3 | 3.34 | 11.5% |

| XEM | 0.12 | 0.13 | 10.3% |

| MNC | 0.0019 | 0.0021 | 9.6% |

| DASH | 124.91 | 128.15 | 2.6% |

Losers of the week (15th July – 21st July 2021)

| Coin | Opening price 15.07, $ |

Opening price 21.07, $ |

Change |

| GNY | 0.39 | 0.28 | -28.9% |

| ROOBEE | 0.003 | 0.0021 | -28.7% |

| PRQ | 0.44 | 0.32 | -27.5% |

| GAS | 7.53 | 5.48 | -27.3% |

| ONE | 0.08 | 0.06 | -24.6% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

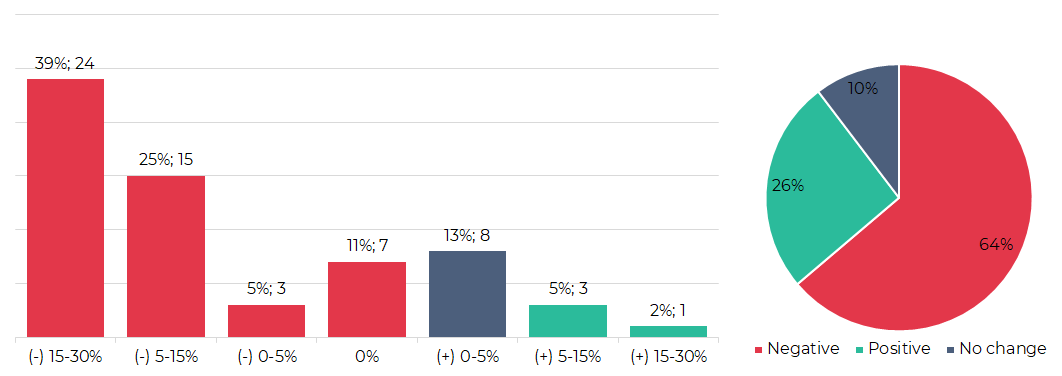

Segmentation of cryptocurrencies based on trading results

(15th – 21st July)

Most traded coins (14th – 20th July 2021)

| Coin | Trading volumes, $ |

| BTC | 20,795,135 |

| ETH | 13,775,213 |

| XRP | 3,461,337 | DOGE | 1,230,305 |

| DASH | 1,180,367 |

| EXM | 848,726 |

| LTC | 839,764 |

| ETC | 782,131 |

| BCH | 756,172 |

| IQN | 586,272 |

Top crypto market driving factors

Bitcoin (BTC) and the overall crypto market

▲ 15.07.2021 – MicroStrategy CEO, Michael Saylor, says he is not going to sell any tokens – his personal ones or those belonging to the company – no matter how low bitcoin’s price goes. Saylor also noted that BTC is one of the few assets that meet the criteria of potential upside movements by a factor of 100.

▲ 16.07.2021 – CoinDesk: Bank of America approves bitcoin futures trading for some clients on the Chicago Mercantile Exchange (CME) stock exchange.

▲ 18.07.2021 – Bitcoin’s mining difficulty plunged by 4.81% to the current level of 13.67 trillion hashes – the lowest value since January 2020.

▼ 19.07.2021 – Glassnode: most bitcoins being sold now belong to users who bought them in spring 2021 when their price reached an all-time high. 33% of the Bitcoin in circulation “is currently holding an unrealised loss.”

▲19.07.2021 – U.S. SEC filing: Rothschild Investment Corporation has bought 103,059 more shares of Grayscale Bitcoin Trust, bringing its total GBTC holdings to $4.2 million.

▲ 20.07.2021 – Fidelity Digital Assets survey: 90% of institutional investors plan to invest in cryptocurrencies by 2026.

▲▼ 21.07.2021 – The B Word Bitcoin conference launched in tandem with ARK Invest and Paradigm Ventures which is scheduled to take place on 21st July. Tesla CEO, Elon Musk, and Twitter CEO, Jack Dorsey, have agreed to participate in a discussion at an upcoming event.

Ethereum (ETH)

▲ 14.07.2021 – Santiment: The top 10 Ethereum wallets have increased their holdings from 18.46% to 20.58% of ETH’s total supply. Ethereum (ETH) supply on centralised exchanges keeps dropping.

▼ 19.07.2021 – Anthony Di Iorio, a co-founder of the Ethereum blockchain, is cutting ties with the crypto industry due to personal safety.

▲ 19.07.2021– U.S. SEC filing: Rothschild Investment has reportedly bought 13,817 more shares of Grayscale Ethereum Trust, boosting its ETHE holdings to $6.3 million.

Dogecoin (DOGE)

▼ 14.07.2021 – Dogecoin co-creator, Jackson Palmer, says “cryptocurrency is an inherently right-wing, hyper-capitalistic technology built primarily to amplify the wealth of its proponents through a combination of tax avoidance, diminished regulatory oversight and artificially enforced scarcity”.

▲ 17.07.2021 – Elon Musk has posted several new tweets about dogecoin and updated his Twitter profile picture to a photo of him with DOGE.

▲ 19.07.2021 – Body spray brand, AXE, drops a limited run of free Dogecan — a Dogecoin-themed body spray. Early Dogecan samples have already been sent to popular Dogecoin personalities from Twitter.

Cardano (ADA)

▲ 14.07.2021 – Cardano has successfully deployed the Alonzo White hard fork, marking a new milestone in the Smart Contract journey.

▲ 16.07.2021 – Spores has raised $2.3 million in the funding round, ramping its efforts towards becoming the first full-stack NFT and DeFi marketplace to adopt and integrate with Cardano blockchain.

Polkadot (DOT)

▲ 15.07.2021 – Messari: as of July, Polkadot is the top invested asset across 44 crypto venture and hedge funds. 44% of our tracked funds have DOT in their portfolios.

XRP (XRP)

▲ 15.07.2021 – A U.S. magistrate judge has allowed Ripple to depose William H. Hinman, the former director of the SEC’s Division of Corporate Finance.

▲ 16.07.2021 – XRP ledger foundation, a non-profit organisation that supports the development of the XRP Ledger, has opened its new office in Tallinn, Estonia.

▲ 19.07.2021 – Lawyers representing Ripple CEO, Brad Garlinghouse, and co-founder, Chris Larsen, have filed a notice of supplemental authority with the court to bolster their motions to dismiss the case brought by the U.S. SEC.

EOS (EOS)

▲ 16.07.2021 – A Tokyo-based SoftBank investment arm plans to invest $75 million in Block.one’s new crypto exchange, Bullish, to purchase 7.5 million shares for $10 each.

Chilliz (CHZ)

▲ 20.07.2021 – Premier League football club, Arsenal F.C., partners with Chilliz to launch the $AFC fan token.

Maker (MKR)

▲ 19.07.2021 – MakerDAO (MKR) to be allocated 6.49% of Grayscale’s new DeFi fund.

▲ 20.07.2021 – Maker Foundation CEO, Rune Christensen, has announced that the DeFi platform has “gone through a full development cycle” and is now fully decentralised. He has also stated that “there are now over 5 billion Dai in circulation and more than $8 billion of assets locked in smart contracts of the Maker protocol.”

Uniswap (UNI)

▲ 19.07.2021 – Uniswap to be allocated 49.95% of Grayscale’s new DeFi fund.

Yearn Finance (YFI)

▲ 19.07.2021 – Yearn Finance (YFI) to be allocated 3.31% of Grayscale’s new DeFi fund.

Crypto market trends

Regulation

The US government is creating a ransomware task force to fight hackers who distribute ransomware in cryptocurrencies.

The US government is creating a ransomware task force to fight hackers who distribute ransomware in cryptocurrencies.

The Financial Accounting Standards Board was called on to develop reporting requirements for companies with investments in cryptocurrencies.

The Financial Accounting Standards Board was called on to develop reporting requirements for companies with investments in cryptocurrencies.

The New Jersey Bureau of Securities has ordered BlockFi’s cryptocurrency lending service to suspend new user registrations across the state. The regulator believes that the platform finances its borrowing operations through the sale of unregistered securities.

The New Jersey Bureau of Securities has ordered BlockFi’s cryptocurrency lending service to suspend new user registrations across the state. The regulator believes that the platform finances its borrowing operations through the sale of unregistered securities.

The European Commission intends to ban anonymous cryptocurrency transfers. If the new bill is passed, companies that carry out transactions with digital assets will be required to collect the recipient and sender data.

The European Commission intends to ban anonymous cryptocurrency transfers. If the new bill is passed, companies that carry out transactions with digital assets will be required to collect the recipient and sender data.

UK Financial Regulator launches a $15 million campaign to educate young people about the risks of investing in cryptocurrencies.

UK Financial Regulator launches a $15 million campaign to educate young people about the risks of investing in cryptocurrencies.

The High Court of Delhi has called for the development of standardised disclaimers for TV advertisements related to digital assets. The development of such guidelines could signal the Indian authorities’ refusal to outrightly ban cryptocurrencies.

The High Court of Delhi has called for the development of standardised disclaimers for TV advertisements related to digital assets. The development of such guidelines could signal the Indian authorities’ refusal to outrightly ban cryptocurrencies.

Japan Financial Services Agency has established a unit to oversee the regulation of digital assets, including DeFi. The authorities are concerned that the proliferation of “new forms of private money” could undermine the country’s financial system.

Japan Financial Services Agency has established a unit to oversee the regulation of digital assets, including DeFi. The authorities are concerned that the proliferation of “new forms of private money” could undermine the country’s financial system.

Turkey has completed the development of a draft bill on the regulation of cryptocurrencies. Its consideration is scheduled for October 2021.

Turkey has completed the development of a draft bill on the regulation of cryptocurrencies. Its consideration is scheduled for October 2021.

The representative of the Ministry of Internal Affairs of the Russian Federation stated that the department had difficulty in suppressing the cryptocurrency fraud due to the inability to track transactions with digital assets.

The representative of the Ministry of Internal Affairs of the Russian Federation stated that the department had difficulty in suppressing the cryptocurrency fraud due to the inability to track transactions with digital assets.

Acceptance of cryptocurrencies

Paraguayan congressman, Carlos Rejala, has proposed a bill to regulate ownership and registration of crypto as well as crypto mining operations. Contrary to the expectations, Rejala was not working on the adoption of Bitcoin as legal tender.

Paraguayan congressman, Carlos Rejala, has proposed a bill to regulate ownership and registration of crypto as well as crypto mining operations. Contrary to the expectations, Rejala was not working on the adoption of Bitcoin as legal tender.

PayPal has announced that it is increasing its purchase limit for cryptocurrencies from $20,000 to $100,000 per week.

PayPal has announced that it is increasing its purchase limit for cryptocurrencies from $20,000 to $100,000 per week.

US State Department offers to pay for cybercrime tips with crypto.

US State Department offers to pay for cybercrime tips with crypto.

A blockchain task force at Jackson, Tennessee, explored methods to accept property tax payments in Bitcoin.

A blockchain task force at Jackson, Tennessee, explored methods to accept property tax payments in Bitcoin.

According to Finbold, during the first half of 2021, crypto trading apps have surpassed stock trading apps in the US market for the first time.

According to Finbold, during the first half of 2021, crypto trading apps have surpassed stock trading apps in the US market for the first time.

Jack Dorsey’s Square company plans to create an open platform for developers of non-custodial, permissionless, and decentralised financial services. Following this announcement, Ark Invest has increased its investments in Square Holdings.

Jack Dorsey’s Square company plans to create an open platform for developers of non-custodial, permissionless, and decentralised financial services. Following this announcement, Ark Invest has increased its investments in Square Holdings.

CBDC and stablecoins

Federal Reserve Chairman, Jerome Powell, stated that stablecoins are going to be a significant part of the payments universe, unlike cryptocurrencies. At the same time, Powell has questioned the need for stablecoins and cryptocurrencies as soon as the digital dollar is launched. The FED chairman also stressed that the dollar won’t lose its dominance as a reserve currency after the launch of CBDC in other countries.

Federal Reserve Chairman, Jerome Powell, stated that stablecoins are going to be a significant part of the payments universe, unlike cryptocurrencies. At the same time, Powell has questioned the need for stablecoins and cryptocurrencies as soon as the digital dollar is launched. The FED chairman also stressed that the dollar won’t lose its dominance as a reserve currency after the launch of CBDC in other countries.

US Treasury Secretary, Janet Yellen, called for a regulatory framework for stablecoins. The likely reason for this was that Tether changed the procedure of how USDT can be backed. According to the financial regulator, the company bought 20% of the bonds of the short-term debt market of American corporations and stopped issuing new tokens since the beginning of May. If the company starts selling these bonds, the US stock market will be under pressure.

US Treasury Secretary, Janet Yellen, called for a regulatory framework for stablecoins. The likely reason for this was that Tether changed the procedure of how USDT can be backed. According to the financial regulator, the company bought 20% of the bonds of the short-term debt market of American corporations and stopped issuing new tokens since the beginning of May. If the company starts selling these bonds, the US stock market will be under pressure.

Tether has founded Tether Impact, a non-profit initiative that will actively promote USDT. The challenge for the new fund is to achieve massive adoption of the stablecoin in the cryptocurrency market and find possible replacements for Chinese investors.

Tether has founded Tether Impact, a non-profit initiative that will actively promote USDT. The challenge for the new fund is to achieve massive adoption of the stablecoin in the cryptocurrency market and find possible replacements for Chinese investors.

Mastercard is working to simplify crypto conversions on its payment card offering for cryptocurrency companies. USDC and PAX are also involved in the pilot project.

Mastercard is working to simplify crypto conversions on its payment card offering for cryptocurrency companies. USDC and PAX are also involved in the pilot project.

Republican Senators urged the U.S. Olympic Committee to forbid American athletes from using China’s new digital currency at the 2022 Beijing Winter Olympics, citing espionage and data security concerns.

Republican Senators urged the U.S. Olympic Committee to forbid American athletes from using China’s new digital currency at the 2022 Beijing Winter Olympics, citing espionage and data security concerns.

The People’s Bank of China (PBOC) has published a new whitepaper on the digital Yuan that states that the Chinese CBDC can be programmed with smart contracts.

The People’s Bank of China (PBOC) has published a new whitepaper on the digital Yuan that states that the Chinese CBDC can be programmed with smart contracts.

The Governing Council of the European Central Bank (ECB) has decided to launch the investigation phase of a digital euro project. The phase will last two years and aim to address issues regarding CBDC design and distribution.

The Governing Council of the European Central Bank (ECB) has decided to launch the investigation phase of a digital euro project. The phase will last two years and aim to address issues regarding CBDC design and distribution.

El Salvador president Nayib Bukele’s brothers, Ibrajim and Yusef Bukele, reportedly met with representatives from Cardano, WhizGrid and Algorand to discuss the release of the stablecoin known as the ‘Colon dollar.’

El Salvador president Nayib Bukele’s brothers, Ibrajim and Yusef Bukele, reportedly met with representatives from Cardano, WhizGrid and Algorand to discuss the release of the stablecoin known as the ‘Colon dollar.’

Big business

Larry Fink, the CEO of Blackrock, the world’s largest asset manager, declares that the company has been seeing less crypto-related queries from investors recently, signaling a massive drop in demand for crypto.

Larry Fink, the CEO of Blackrock, the world’s largest asset manager, declares that the company has been seeing less crypto-related queries from investors recently, signaling a massive drop in demand for crypto.

According to a filing with the U.S. Securities and Exchange Commission, Capital International Investors, a division of Los Angeles-based Capital Group, has acquired a 12.2% stake in MicroStrategy. Meanwhile BlackRock, the world’s largest sovereign wealth fund, remains the biggest MicroStrategy shareholder with a 14.56% stake.

According to a filing with the U.S. Securities and Exchange Commission, Capital International Investors, a division of Los Angeles-based Capital Group, has acquired a 12.2% stake in MicroStrategy. Meanwhile BlackRock, the world’s largest sovereign wealth fund, remains the biggest MicroStrategy shareholder with a 14.56% stake.

The Street states that the hedge fund-of-funds units of both JPMorgan and UBS have joined hands to back portfolio managers actively trading in digital assets. Two banking giants are reported to be carrying out their due diligence for crypto strategies. JPMorgan has also opened more than 80 blockchain-related jobs.

The Street states that the hedge fund-of-funds units of both JPMorgan and UBS have joined hands to back portfolio managers actively trading in digital assets. Two banking giants are reported to be carrying out their due diligence for crypto strategies. JPMorgan has also opened more than 80 blockchain-related jobs.

According to CoinDesk, Bank of America, the second-largest bank in the U.S., has approved the trading of bitcoin futures through Chicago Mercantile Exchange (CME) Group for some clients.

According to CoinDesk, Bank of America, the second-largest bank in the U.S., has approved the trading of bitcoin futures through Chicago Mercantile Exchange (CME) Group for some clients.

Mining

Bitcoin’s mining difficulty plunged by 4.81% to the current level of 13.67 trillion hashes – the lowest value since January 2020. Overall, mining difficulty has decreased by 45% since mid-May 2021.

Bitcoin’s mining difficulty plunged by 4.81% to the current level of 13.67 trillion hashes – the lowest value since January 2020. Overall, mining difficulty has decreased by 45% since mid-May 2021.

According to the Cambridge Centre for Alternative Finance (CCAF) research, China’s share of total Bitcoin mining power started declining sharply even before a government crackdown in June 2021. It has declined from 75.5% in September 2019 to 46% in April 2021.

According to the Cambridge Centre for Alternative Finance (CCAF) research, China’s share of total Bitcoin mining power started declining sharply even before a government crackdown in June 2021. It has declined from 75.5% in September 2019 to 46% in April 2021.

According to CCAF, Kazakhstan saw an almost sixfold increase in its share of global bitcoin mining – from 1.4% in September 2019 to 8.2% in April 2021. Meanwhile, the U.S. share of the total Bitcoin hashrate rose to 16.8% from 4.1%. Russia and Iran complete the top five list of largest countries for bitcoin mining with 6.8% and 4.6%, respectively.

According to CCAF, Kazakhstan saw an almost sixfold increase in its share of global bitcoin mining – from 1.4% in September 2019 to 8.2% in April 2021. Meanwhile, the U.S. share of the total Bitcoin hashrate rose to 16.8% from 4.1%. Russia and Iran complete the top five list of largest countries for bitcoin mining with 6.8% and 4.6%, respectively.

Russian crypto industry association, RACIB, launched a project to attract crypto mining firms to the country.

Russian crypto industry association, RACIB, launched a project to attract crypto mining firms to the country.

Malaysian police destroyed more than 1,000 bitcoin mining machines confiscated during six separate raids between February and April 2021.

Malaysian police destroyed more than 1,000 bitcoin mining machines confiscated during six separate raids between February and April 2021.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.

The post Weekly recap: cryptomarket under pressure appeared first on EXMO Info Hub.