Crypto market in numbers

Crypto market capitalisation reached $2 trillion for the first time since May , decreasing to $1.9 trillion by 18th August, according to CoinMarketCap. Over the past 7 days, it has grown by 2.6%. The growth in capitalisation was not accompanied by a significant change in trading volumes.

The Fear and Greed Index remains in the “Greed” zone for 12 days. Since 10th August 2021, it has not dropped below 70 points.

The Bitcoin 30-day volatility index has grown to 3.52% over the week , according to CryptoCompare. In general, volatility has remained low over the past 2 months.

For four consecutive weeks, the bitcoin rate completed each trading day with an increase. Last week, its price reached $48,000. In 30 days it increased by 60%, but on 18th August 2021, it fell to 44%.

Bitcoin’s dominance of the crypto market over the week decreased by 1.1% to 44.36%. Ethereum’s share also dropped to 18.65%.

Gainers of the week (12th – 18th August 2021)

| Coin | Opening price 12.08, $ | Opening price 18.08, $ | Change |

| WXT | 0.009 | 0.013 | 55.6% |

| ROOBEE | 0.005 | 0.006 | 28.1% |

| PRQ | 0.52 | 0.63 | 20.9% |

| WAVES | 18.65 | 22.52 | 20.8% |

| QTUM | 10.82 | 13.00 | 20.1% |

Losers of the week (12th – 18th August 2021)

| Coin | Opening price 12.08, $ | Opening price 18.08, $ | Change |

| TONCOIN | 1.17 | 0.44 | -62.7% |

| ZAG | 0.90 | 0.76 | -15.2% |

| VLX | 0.054 | 0.048 | -11.5% |

| UNI | 29.06 | 26.62 | -8.4% |

| ALGO | 0.95 | 0.89 | -5.9% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

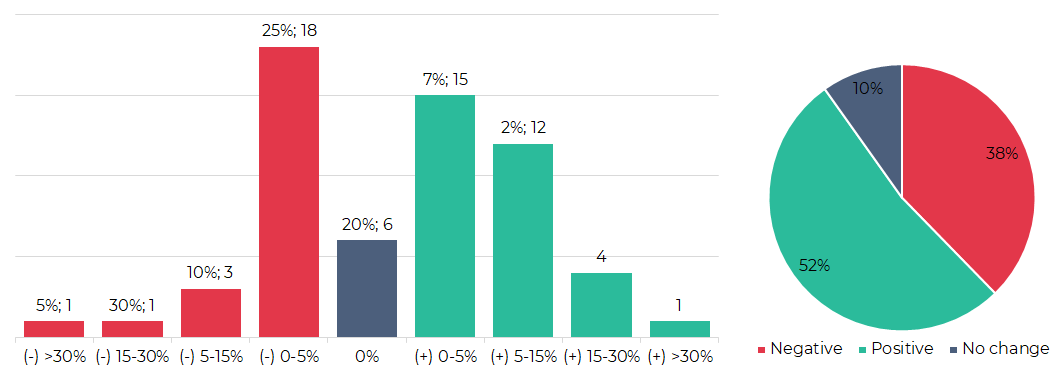

Segmentation of cryptocurrencies based on trading results (12th – 18th August 2021)

Most traded coins (11th – 17th August 2021)

| Coin | Trading volumes, $ |

| BTC | 47,277,200 |

| ETH | 36,141,024 |

| XRP | 30,600,060 |

| DOGE | 4,384,177 |

| ADA | 2,419,930 |

| ETC | 2,355,119 |

| LTC | 2,281,479 |

| DASH | 1,886,052 |

| ROOBEE | 1,632,505 |

| BCH | 1,254,412 |

Top crypto market driving factors

Bitcoin (BTC) and the overall crypto market

▲ 11.08.2021 – The Nasdaq-listed auto insurance company, Metromile, has purchased $1 million in bitcoin.

▲14.08.2021 – MacroScope on Twitter: four wealth management companies have acquired shares of Grayscale’s Bitcoin Investment Trust (GBTC).

▲▼ 15.08.2021 – Tether issued an additional 1 billion USDT.

Ethereum (ETH)

▲ 11.08.2021 – According to the filing with SEC, Neuberger Berman’s investment strategy will permit actively managed exposure to digital assets through crypto derivatives, such as bitcoin and ether futures, as well as investments in bitcoin trusts and exchange-traded funds to gain indirect exposure to BTC.

▲ 12.08.2021 – The Nasdaq-listed Chinese blockchain company, Powerbridge Technologies, intends to invest and engage in cryptocurrency mining for Bitcoin and Ethereum with planned operations, globally.

▲13.08.2021 – Kryptoin Investment Advisors have filed for an Ethereum exchange-traded fund (ETF) with the United States Securities and Exchange Commission (SEC).

▲ 13.08.2021 – Santiment: in only three years, Ethereum whale addresses with more than 10,000 ETH increased their holdings from 35.8% to 43.7% of the total cryptocurrency supply.

▲ 16.08.2021 – Glassnode: the number of non-zero Ethereum wallets hit a new ATH of 16.5 million.

▲ 16.08.2021 – The Ethereum 2.0 deposit contract with more than 5.8% of the cryptocurrency market supply has become the largest ETH holder.

▲ 16.08.2021 – Microsoft plans to develop an anti-piracy solution that is set to run on the Ethereum blockchain.

Cardano (ADA)

▲ 11.08.2021 – The Cardano Foundation minted Non-Fungible Tokens of Appreciation (NFTAs). NFTAs are NFTs which will be given to 10 developers that provided feedback and helped build the developer portal.

▲ 13.08.2021 – Cardano’s developers have announced that the launch of smart contracts on the network will take place on 12th September.

▲ 13.08.2021 – Santiment: Cardano developer activity exceeded Ethereum.

▲ 13.08.2021 – IntoTheBlock: the number of addresses holding ADA for more than a year hit a new ATH of 221,490.

▲ 16.08.2021 – CoinShares: between 9th-15th August, Cardano (ADA) investment products raised $1.3 million from investors – more than Ethereum and Bitcoin. The coin was placed first in the monthly interval with a total capital inflow of $2.1 million.

XRP (XRP)

▲▼12.08.2021 – A platform Whale Alert has spotted five large transfers carrying a total of 138 million XRP.

▼ 12.08.2021 – XRPSCAN: Ripple Labs co-founder and ex-CTO, Jed McCaleb, sold 80 million XRP over the past two weeks.

▲ 14.08.2021 – Santiment: XRP developer activity on Github hit a new ATH.

Dogecoin (DOGE)

▲ 13.08.2021 – Billionaire, Mark Cuban, told CNBC’s ‘Make It’ that Dogecoin is the ‘strongest’ cryptocurrency as a medium of exchange.

▲ 13.08.2021 – The professional basketball team that Mark Cuban owns, the Dallas Mavericks, will offer special pricing for those paying with Dogecoin during the summer sale.

▲ 14.08.2021 – Players from English soccer team, Watford F.C., will wear Dogecoin shirts for the new Premier League season. The deal is worth at least GBP £700,000 and will be paid by betting site and crypto casino, Stake.com.

▲ 14.08.2021 – Elon Musk echoed Mark Cuban’s views on Dogecoin tweeting, “I’ve been saying this for a while”.

▲ 15.08.2021 – Mark Cuban on Twitter: “The point about DOGE that people miss is that DOGE’s imperfections and simplicity are its greatest strengths. You can only use it to do 2 things: Spend It or HODL It. Both are easy to understand. And it’s cheap to buy. Which makes it a community anyone can join and enjoy”.

▲ 16.08.2021 – The US publicly traded company, Bots Inc., is now allowing local car dealerships to accept cryptocurrencies like Dogecoin for pre-owned TESLA EV cars.

▲ 17.08.2021 – The core developers behind Dogecoin have announced the members of the renewed Dogecoin Foundation. Its new advisory board includes Ethereum co-founder, Vitalik Buterin and Elon Musk’s representative, Jared Birchall.

Uniswap (UNI)

▲ 11.08.2021 – Uniswap has become the first DeFi protocol to generate more than $1 billion worth of platform fees for liquidity providers.

Chainlink (LINK)

▲ 12.08.2021 – Chainlink has launched data oracles on Arbitrum One – the beta mainnet deployment of layer-two Ethereum scaling solution, Arbitrum.

Stellar (XLM)

▲ 11.08.2021 – A remittance corridor was opened between the 27 European Union countries and Thailand on the Stellar blockchain.

▲ 12.08.2021 – CLPX has launched a stablecoin pegged to the Chilean peso and copper reserves on the Stellar blockchain.

Tron (TRX)

▲ 16.08.2021 – The number of addresses on the Tron blockchain network hit a new ATH of 50 million with the total amount of blocked funds in DeFi-protocols of $10 billion.

Chiliz (CHZ)

▲ 12.08.2021 – Reuters: Lionel Messi’s signing on fee at Paris St Germain includes some of the French club’s cryptocurrency fan tokens issued on the Chiliz platform.

Crypto market trends

Regulation

The chairman of the US Securities and Exchange Commission (SEC), Gary Gensler, outlined his concerns and priorities in the crypto sector in a letter to Senator Elizabeth Warren, stating that “additional authorities” and “more resources to protect investors in this growing and volatile sector” are needed. He stated that legislative priority should center on crypto trading, lending and DeFi platforms.

The chairman of the US Securities and Exchange Commission (SEC), Gary Gensler, outlined his concerns and priorities in the crypto sector in a letter to Senator Elizabeth Warren, stating that “additional authorities” and “more resources to protect investors in this growing and volatile sector” are needed. He stated that legislative priority should center on crypto trading, lending and DeFi platforms.

The commissioner of the Commodity Futures Trading Commission (CFTC), Brian Quintenz, has tweeted that “ETH a non-security commodity”.

The commissioner of the Commodity Futures Trading Commission (CFTC), Brian Quintenz, has tweeted that “ETH a non-security commodity”.

US lawmakers have urged CFTC and SEC to form a joint working group to work with participants in the crypto space for transparency and regulatory clarity.

US lawmakers have urged CFTC and SEC to form a joint working group to work with participants in the crypto space for transparency and regulatory clarity.

Empower Oversight, a non-profit organisation, has submitted a detailed FOIA request to the US SEC, “seeking communications between SEC officials and their current and former employers”. The organisation suspects former SEC employees of bias towards Bitcoin and Ethereum valuation, as well as in prosecuting Ripple.

Empower Oversight, a non-profit organisation, has submitted a detailed FOIA request to the US SEC, “seeking communications between SEC officials and their current and former employers”. The organisation suspects former SEC employees of bias towards Bitcoin and Ethereum valuation, as well as in prosecuting Ripple.

The Central Committee of the Communist Party of China’s, Central People’s Government five-year plan, aims at strengthening oversight in the areas of national security and technological innovation with focus on ecology, which suggests that the ban on cryptocurrency mining is permanent.

The Central Committee of the Communist Party of China’s, Central People’s Government five-year plan, aims at strengthening oversight in the areas of national security and technological innovation with focus on ecology, which suggests that the ban on cryptocurrency mining is permanent.

As reported by the Shenzhen branch of The People’s Bank of China, 46 companies are suspected of being involved with illegal crypto trading, with 11 being shut down as the result of an ongoing investigation by the bank’s special task force.

As reported by the Shenzhen branch of The People’s Bank of China, 46 companies are suspected of being involved with illegal crypto trading, with 11 being shut down as the result of an ongoing investigation by the bank’s special task force.

The first deputy governor at the Central Bank of Russia, Sergey Shvetsov, urged local investors to beware of alternative financial instruments such as bitcoin. In his opinion, allocating money in the asset is highly risky and could result in losses.

The first deputy governor at the Central Bank of Russia, Sergey Shvetsov, urged local investors to beware of alternative financial instruments such as bitcoin. In his opinion, allocating money in the asset is highly risky and could result in losses.

President of Russia, Vladimir Putin, approved an anti-corruption plan for 2021-2024, instructing the Government to prepare proposals aimed at verifying data on ownership of cryptocurrencies by 15th November 2021.

President of Russia, Vladimir Putin, approved an anti-corruption plan for 2021-2024, instructing the Government to prepare proposals aimed at verifying data on ownership of cryptocurrencies by 15th November 2021.

CBDC and stablecoins

Novi Financial company that is behind the Diem project, is in talks with stablecoin issuers Circle and Paxos. Previously, a former Facebook project planned to launch a dollar stablecoin in cooperation with Silvergate bank, but the issue has not yet commenced.

Novi Financial company that is behind the Diem project, is in talks with stablecoin issuers Circle and Paxos. Previously, a former Facebook project planned to launch a dollar stablecoin in cooperation with Silvergate bank, but the issue has not yet commenced.

Coinbase has removed the claim that “each USDC is backed by one U.S. dollar held in a bank account” from its website. According to the updated text, the stablecoin is “backed by fully reserved assets”.

Coinbase has removed the claim that “each USDC is backed by one U.S. dollar held in a bank account” from its website. According to the updated text, the stablecoin is “backed by fully reserved assets”.

According to CoinGecko, the total amount of USDC in circulation is approaching $28 billion, which is about 43% of the USDT supply. The daily trading volumes of stablecoin are approximately 22 times less. According to Coin Metrics, USDC emission has grown by $1 billion over the month.

According to CoinGecko, the total amount of USDC in circulation is approaching $28 billion, which is about 43% of the USDT supply. The daily trading volumes of stablecoin are approximately 22 times less. According to Coin Metrics, USDC emission has grown by $1 billion over the month.

The Wall Street Journal expressed concerns that the asset portfolio used to back up the Tether stablecoin doesn’t meet institutional standards.

More than two-thirds of all USDT tokens were issued to order by Alameda Research and Cumberland Global cryptocurrency companies, reports the Protos portal. Companies are presumably using stablecoins to provide liquidity to the markets in which they operate.

More than two-thirds of all USDT tokens were issued to order by Alameda Research and Cumberland Global cryptocurrency companies, reports the Protos portal. Companies are presumably using stablecoins to provide liquidity to the markets in which they operate.

On 15th August, Tether issued an additional 1 billion USDT. According to Coin Metrics, the total supply is approaching $66 billion.

On 15th August, Tether issued an additional 1 billion USDT. According to Coin Metrics, the total supply is approaching $66 billion.

Chinese company, Honor, has unveiled the flagship smartphone Magic3 with a hardware cryptocurrency wallet supporting the digital yuan.

Chinese company, Honor, has unveiled the flagship smartphone Magic3 with a hardware cryptocurrency wallet supporting the digital yuan.

Acceptance of cryptocurrencies

Argentine President, Alberto Fernandez, has not excluded the possibility of legalising bitcoin, as well as issuing a CBDC.

Argentine President, Alberto Fernandez, has not excluded the possibility of legalising bitcoin, as well as issuing a CBDC.

Argentina’s central bank president, Miguel Pesce, said bitcoin is not a financial asset and has no value. He noted that cryptocurrencies “can be very harmful” for economic stability.

Fitch Ratings believes that recognising bitcoin as legal tender in El Salvador could negatively affect local insurance companies. Regulation of the first cryptocurrency “appears to be overly hasty,” analysts said.

Fitch Ratings believes that recognising bitcoin as legal tender in El Salvador could negatively affect local insurance companies. Regulation of the first cryptocurrency “appears to be overly hasty,” analysts said.

Twitter founder, Jack Dorsey, said that in the future, every social media account can be linked to a Bitcoin wallet with Lightning Network support.

Twitter founder, Jack Dorsey, said that in the future, every social media account can be linked to a Bitcoin wallet with Lightning Network support.

Walmart, the largest American retailer, has opened a cryptocurrency products head position.

Walmart, the largest American retailer, has opened a cryptocurrency products head position.

Decentralised Finance (DeFi)

According to Messari analyst, Ryan Watkins, the total value of assets locked in DeFi reached $148 billion, approaching new ATHs. Most of these are locked on Ethereum, Terra and Solana networks.

According to Messari analyst, Ryan Watkins, the total value of assets locked in DeFi reached $148 billion, approaching new ATHs. Most of these are locked on Ethereum, Terra and Solana networks.

As reported by DappRadar, the most active users of DeFi services are residents of India, China, USA, Thailand and Russia. Significantly lower activity is observed in Europe. Users from the US, Indonesia and Russia are showing the greatest interest in the NFT sector.

As reported by DappRadar, the most active users of DeFi services are residents of India, China, USA, Thailand and Russia. Significantly lower activity is observed in Europe. Users from the US, Indonesia and Russia are showing the greatest interest in the NFT sector.

According to a CipherTrace report, over 75% of the hacks in the cryptocurrency industry in 2021 were related to DeFi projects of decentralised finance. Over the first seven months of this year, DeFi hacks and scams cost the protocols and their users $474 million.

According to a CipherTrace report, over 75% of the hacks in the cryptocurrency industry in 2021 were related to DeFi projects of decentralised finance. Over the first seven months of this year, DeFi hacks and scams cost the protocols and their users $474 million.

Hackers stole more than $7 million in USD Coin from the DAO Maker platform on 12th August 2021.

Hackers stole more than $7 million in USD Coin from the DAO Maker platform on 12th August 2021.

According to the Token analytical platform Terminal, the commission revenue from the Axie Infinity on-chain game surpassed almost three and a half times the revenues of the Ethereum blockchain network.

According to the Token analytical platform Terminal, the commission revenue from the Axie Infinity on-chain game surpassed almost three and a half times the revenues of the Ethereum blockchain network.

Big business

American auto insurer, Metromile, invested $1 million in bitcoin in the first half of 2021.

American auto insurer, Metromile, invested $1 million in bitcoin in the first half of 2021.

Four asset management companies have filed reports with the US SEC on their bitcoin investments made through the Grayscale Bitcoin Trust (GBTC).

Four asset management companies have filed reports with the US SEC on their bitcoin investments made through the Grayscale Bitcoin Trust (GBTC).

Investment company Neuberger Berman, which manages $400 billion in assets, plans to start investing in Bitcoin and Ethereum derivatives.

Investment company Neuberger Berman, which manages $400 billion in assets, plans to start investing in Bitcoin and Ethereum derivatives.

Powerbridge Technologies, a Chinese blockchain company listed on the Nasdaq with a $61 million cap, intends to invest in digital assets and start mining Bitcoin and Ethereum.

Powerbridge Technologies, a Chinese blockchain company listed on the Nasdaq with a $61 million cap, intends to invest in digital assets and start mining Bitcoin and Ethereum.

According to Blockdata research, 55 of the world’s 100 largest banks in terms of asset size, interact with the blockchain and cryptocurrency industries. Barclays, Citigroup and Goldman Sachs are the most active supporters of crypto and blockchain companies. JPMorgan and BNP Paribas were named as ‘serial investors’ in the industry.

According to Blockdata research, 55 of the world’s 100 largest banks in terms of asset size, interact with the blockchain and cryptocurrency industries. Barclays, Citigroup and Goldman Sachs are the most active supporters of crypto and blockchain companies. JPMorgan and BNP Paribas were named as ‘serial investors’ in the industry.

Swiss financial giant, UBS, is the first bank to join Broadridge’s blockchain repo (DLR) platform.

Swiss financial giant, UBS, is the first bank to join Broadridge’s blockchain repo (DLR) platform.

The brokerage arm of Singapore’s largest bank, DBS Bank, has received approval from the country’s financial regulator to provide cryptocurrency services to asset management companies.

The brokerage arm of Singapore’s largest bank, DBS Bank, has received approval from the country’s financial regulator to provide cryptocurrency services to asset management companies.

The Swiss financial organization, Leonteq AG, has announced a partnership with ICF BANK AG aimed at providing digital assets to institutional investors and private clients from Austria and Germany. Investors will receive access to 18 cryptocurrencies, including Bitcoin and Ethereum.

The Swiss financial organization, Leonteq AG, has announced a partnership with ICF BANK AG aimed at providing digital assets to institutional investors and private clients from Austria and Germany. Investors will receive access to 18 cryptocurrencies, including Bitcoin and Ethereum.

Mining

As a result of the last recalculation, Bitcoin’s mining difficulty has increased by another 7% for the second time in a row. July saw a record decrease in mining difficulty amid mining bans in China.

As a result of the last recalculation, Bitcoin’s mining difficulty has increased by another 7% for the second time in a row. July saw a record decrease in mining difficulty amid mining bans in China.

Five publicly listed North American bitcoin mining firms without materially increasing their hashing power have churned out a total of 1,802 bitcoin in July – on average 58% more than what they achieved in June. According to The Block, this was largely caused by a drop in the bitcoin mining difficulty after China issued shutdown orders to local bitcoin mining operations.

Five publicly listed North American bitcoin mining firms without materially increasing their hashing power have churned out a total of 1,802 bitcoin in July – on average 58% more than what they achieved in June. According to The Block, this was largely caused by a drop in the bitcoin mining difficulty after China issued shutdown orders to local bitcoin mining operations.

Toronto-based Bitcoin mining company, Bitfarms, reported that its revenue increased by 396% to $36.7 million in the second quarter of 2021, compared to the same period in 2020.

Toronto-based Bitcoin mining company, Bitfarms, reported that its revenue increased by 396% to $36.7 million in the second quarter of 2021, compared to the same period in 2020.

Mawson Infrastructure Group, a bitcoin mining infrastructure and management provider, has announced its purchase of 17,352 ASIC bitcoin mining rigs from hardware maker, Canaan. Riot Blockchain, a Nasdaq-listed mining company, also plans to continue increasing its mining resources after acquiring 43,500 miners from Bitmain.

Mawson Infrastructure Group, a bitcoin mining infrastructure and management provider, has announced its purchase of 17,352 ASIC bitcoin mining rigs from hardware maker, Canaan. Riot Blockchain, a Nasdaq-listed mining company, also plans to continue increasing its mining resources after acquiring 43,500 miners from Bitmain.

EXMO news

EXMO is now available in the CScalp terminal. Connect your EXMO account to the CScalp platform for more effective day trading.

That’s all for this week! Follow EXMO on YouTube , Twitter and Telegram to stay tuned to the main events and trends in the crypto market.

The post Weekly recap: the rise of altcoins appeared first on EXMO Info Hub .